How to File BIR 1700 Online

The deadline for filing the BIR form 1700 or the Annual Income Tax Return (ITR) is April 15. Here is the guide on how you can file your BIR 1700 online.

Tax is one of those things that can scramble my thinking. True to its name, filing and paying taxes and even discussing it are taxing! Like you, I searched for references far and wide to properly file my ITR last week. Like you, I would get choked up whenever I would see the tax deduction from my payslip because, honestly, are you satisfied with where our taxes go? So, before voting for leaders on May 9, ask yourself, at the very least: did these people, whom I’m about to vote for, fulfill their tax obligations like I did?

Sorry, I digressed for a moment.

Before I go off on a tangent again, here is the process on how you can file your BIR form 1700 online:

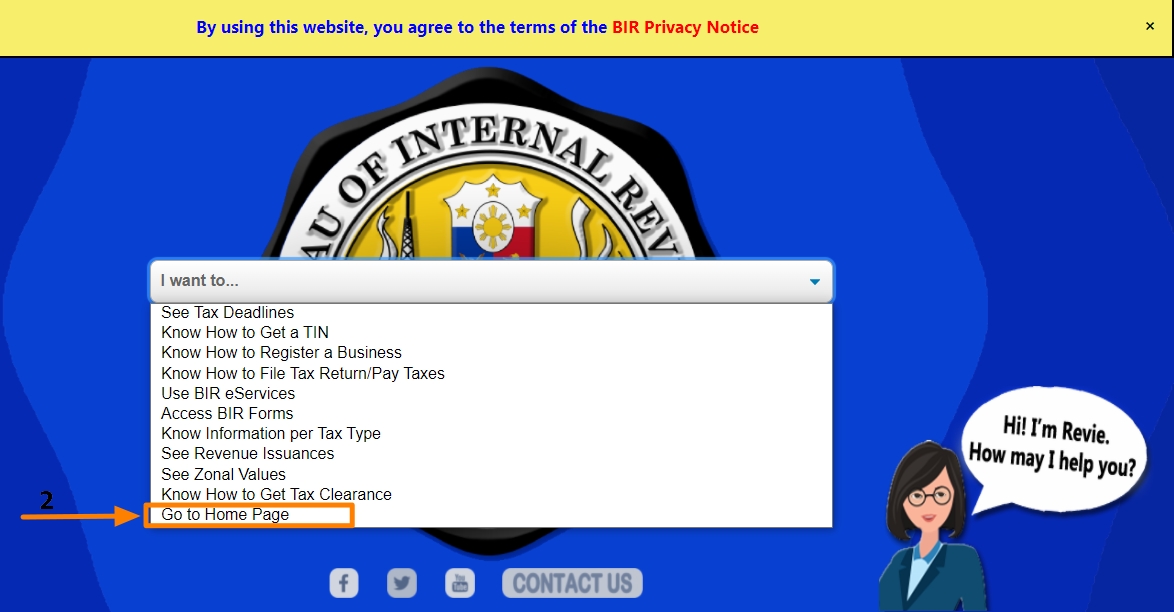

1. Go to the Bureau of Internal Revenue’s (BIR) website.

2. On the landing page, click the I WANT TO dropdown and select “Go to Homepage.”

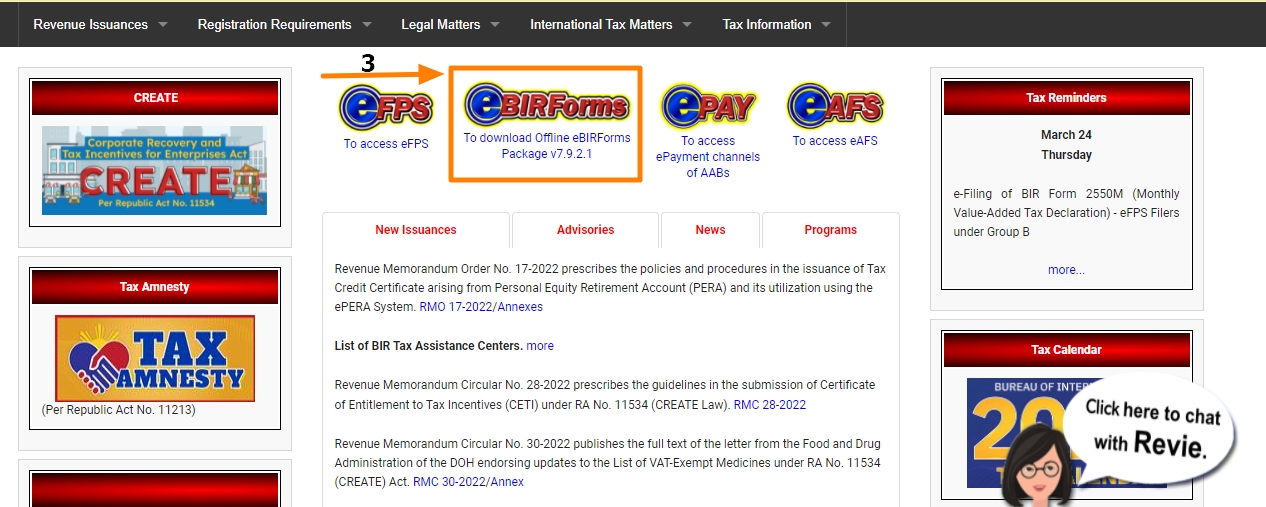

3. Once you are successfully redirected to the Home page, scroll down, look for the eBIRForms package, and click it. The download process should automatically begin.

4. Install the software.

5. Once successfully installed, launch the application.

6. Complete the “Profile” section by inputting your Tax Identification Number (TIN), RDO code, line of business, complete name, registered address, zip code, and telephone number, and provide your ACTIVE email address. BIR will send the confirmation of receipt of your ITR to this email address.

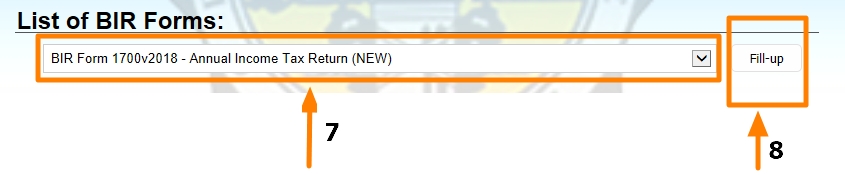

7. From the “List of BIR Forms,” look for the BIR Form 1700v2018 – Annual Income Tax Return (NEW).

8. Click FILL UP.

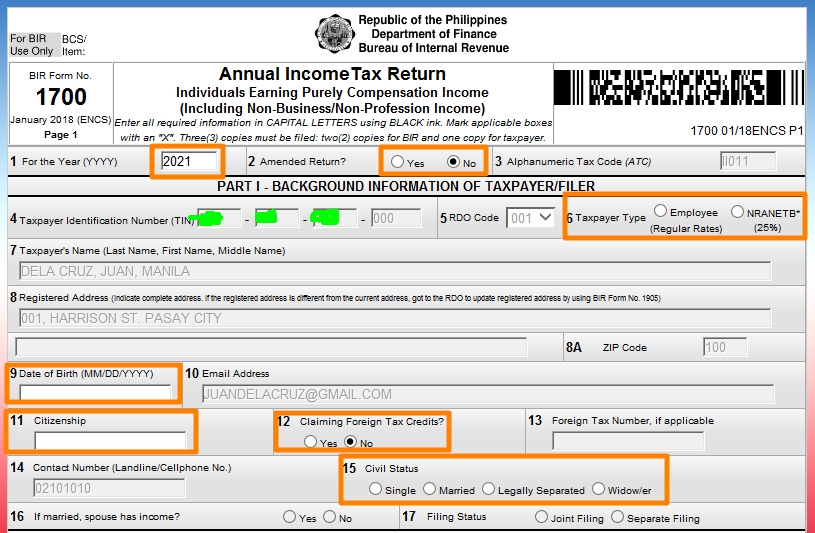

9. You should be redirected to the ITR Form.

10. Fill out the enabled items under the “PART I – BACKGROUND INFORMATION OF TAXPAYER,” as needed.

11. If you are married, complete “PART II – BACKGROUND INFORMATION ON SPOUSE.” If otherwise, proceed to step 12.

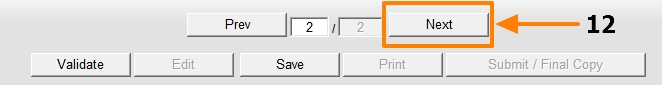

12. Scroll down and click NEXT.

13. Fill out “PART VI – Schedule” by ticking the box beside “Taxpayer.” The employer’s name and TIN boxes shall be activated, then input the necessary information. Do the same for the “Spouse” item if you are married.

14. Follow the same process in step 13 for all the employers you had within the taxable/ covered year.

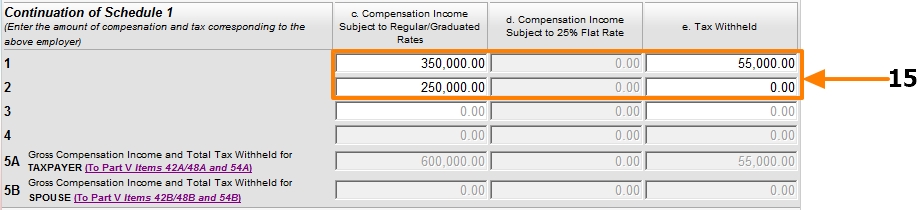

15. In the “Continuation of Schedule 1,” input the compensations you received and the taxes withheld by each employer in sub-sections C and E.

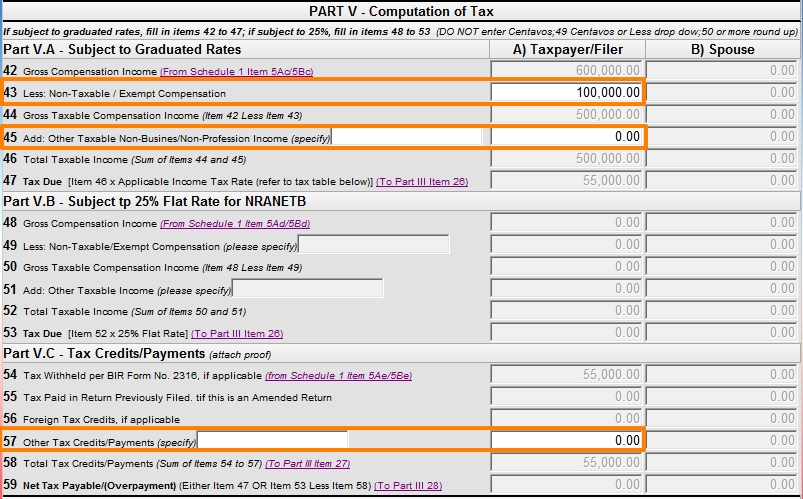

16. Go back to “PART V – COMPUTATION OF TAX” and answer item numbers 43, 45, and 57, if applicable.

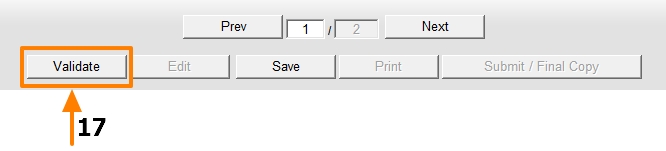

17. Click VALIDATE to check if you missed any required fields or if you inputted any invalid TINs.

18. If everything is in order, click SUBMIT/ FINAL COPY.

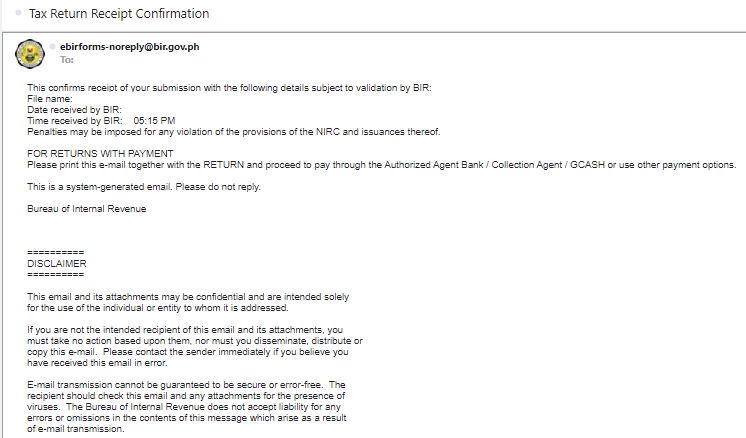

19. You shall receive the Tax Return Receipt Confirmation email from ebirforms-noreply@bir.gov.ph. The confirmation email is not sent immediately. You may receive it after a few hours from the submission of the ITR.

FINAL STEP:

Refer to item number 35 of the form; if there is any amount in it, both payable and overpayment, print the Tax Return Receipt Confirmation email and the completed BIR form 1700. Pay the amount due through either Authorized Agent Banks (AABs)/ Revenue Collection Officers (RCOs) or electronic payment facilities. Once paid, email the soft copies of your forms 1700, 2316s, and the proof of paid returns to esubmission@bir.gov.ph.

If the amount in item number 35 is zero, there is no further action needed. Keep the Tax Return Receipt Confirmation email from BIR for future needs.

ADDITIONAL REFERENCES:

DISCLAIMER:

I am neither an accountant nor an employee of BIR. If you don’t know what amount goes to each required field, please request assistance from your Payroll department or an accountant. If you have any further questions or clarifications, please contact BIR at +632 8538 3200 or the Regional/ District Offices.

If there are any incorrect details in this post, please drop us a message via the Contact page.